This is a guest post from TAtech Member Public Insight Corporation, written by Dan Quigg, CEO.

Record Job Openings and Quit Rates Influence Market Activity

The April jobs report shows job openings and quit rates remain at record levels while hires have not ticked up to fill the employment gap. With unemployment claims now below pre-pandemic levels, there is still a limited supply of workers to go after. Compared to last April job posting activity declined 13% from 2021. To be fair, 2021 went out the gate fast with everyone trying to get a jump on new hires in a perceived post-pandemic economy.

Labor Market Data – Sounds Good, but it Isn’t

Normally record job openings would signal a burgeoning economy, but not when you combine it with flat hires, record quit rates, low unemployment, and low labor force participation.

- Job openings surged back to record levels at 11.5 million.

- Quit rates also reverted back to record levels at 3%.

- However, hires are flat at 6.5 million as employers struggle to place jobs.

- While the number of workers on the sidelines in unemployment are now below pre-pandemic levels.

- And inflation is at a multi-decade high.

This seems like a new recipe for a recession. Unfortunately, there is no certain way around it other than to drive more workers into the labor force participation pool.

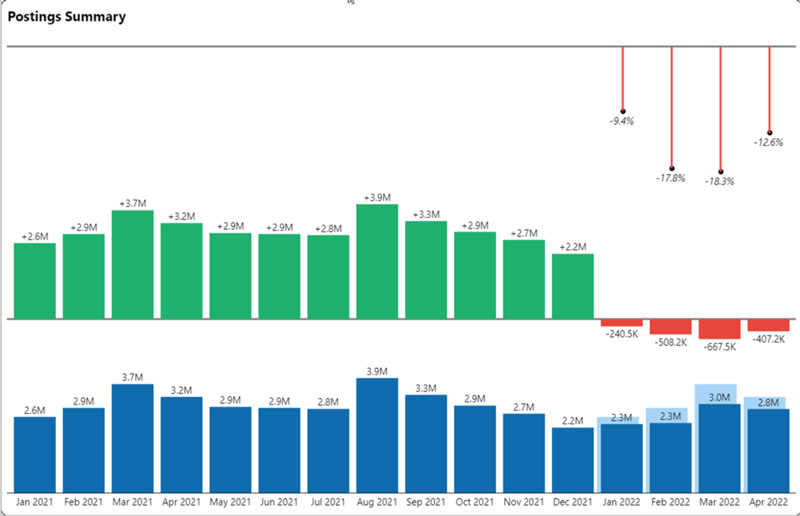

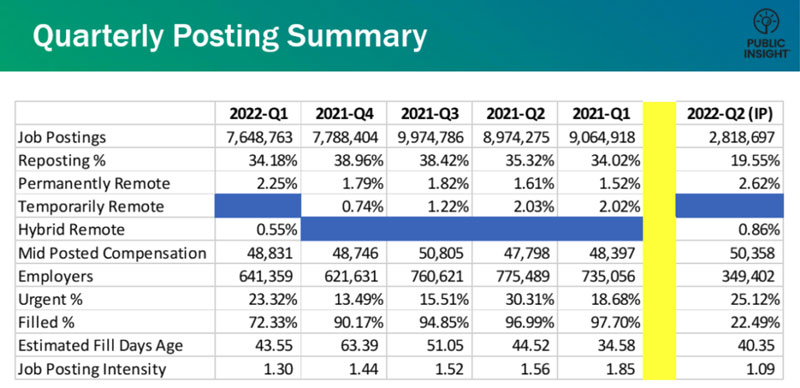

April Jobs Report – Job Postings Activity

The market challenges certainly impacted posting activity. April job postings were 2.8 million down 12.6% from April 2021. This marks the fourth consecutive month in 2022 where postings were less than last year as shown below.

- 72% of Q1 jobs are shown as estimated to be filled based on ad status.

- Reposting rates are already at 34% which will likely trend to more than 40% when most of the jobs are filled. This means that nearly 1 in 2 jobs had to have a repeat ad posted.

- Nearly 1 in 4 jobs in Q1 and thus far in Q2 have been marked as urgent. This is the highest urgency rate since the second quarter of last year.

- Days for open postings was flat in April compared to March at 87.09 days. However, the number of open jobs at the end of April was down 13.6%. There has been some modest improvement in filling jobs but the early April returns indicate some significant challenges for Q2.

- Remote rates continue to increase with permanent remote rates at 2.6% and hybrid rates at nearly 1%. Remote work activity remains concentrated in information, finance and insurance sectors. However, hybrid arrangements are continuing to evolve in other sectors.

- Ad compensation was flat in Q1, but early indications are that compensation levels are rising with May job postings up over 3%.

Employee Sentiment and Ratings Continue Free Fall

We posted last month about the decline in worker satisfaction and employer reputation. This trend is continuing thus far into the second quarter. We curated over 310,000 reviews in April from Indeed® and Glassdoor® in our TalentView Employer Reputation Insights solution and applied text analytics for sentiment scoring and opinion mining.

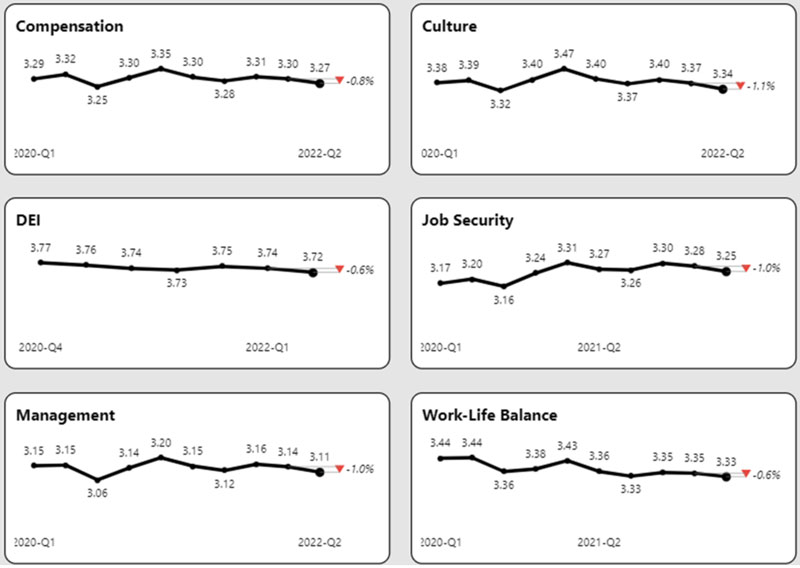

Ratings

Ratings declined across all Indeed and Glassdoor categories in April. All categories with the exception of job security are lower than since the start of the pandemic. Work-life balance has shown the biggest decline.

TalentView – Employer Reputation Insights – Review Ratings

Employee Sentiment Reveals a Passive Workforce

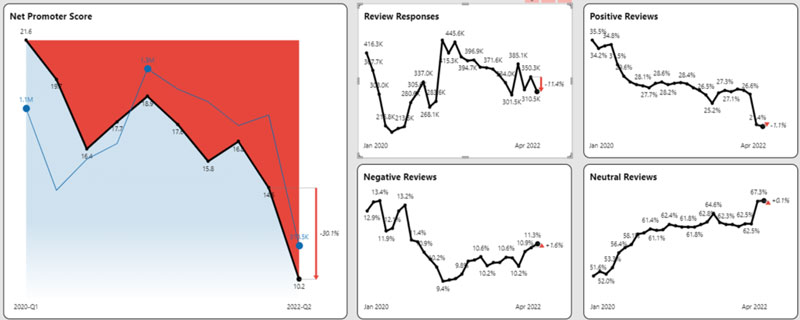

Ratings can be fickle, but sentiment scoring unlocks patterns in the review text. Using text analytics, we measure the sentiment of each review and categorize it into positive, negative and neutral sentiment. We also then compute a net promoter score, which is the percentage of positive scores over negative scores.

Net promoter score continued the decline as positive reviews continue to decline. But the issue is not disgruntled workers, but passive workers.

- The number of positive reviews (positive sentiment scoring of .9 or higher) declined to one in four reviews, which is a significant decline from January 2020 when it was one in three reviews.

- Negative reviews (negative sentiment above .9) creeped up in April, but they are actually down as a percentage from pre-pandemic levels.

- Net promoter score is down barely in the positive territory at 10. This means that a very small percentage of reviewers are fans of the companies they work for.

- What is surprising is that neutral reviews are what is driving the decline in net promoter rating. Neutral reviews are the majority of reviews meaning that the reviewer is presenting neither positive or negative views. It could mean they are expressing passive language or simply mixed messages.

Get More April Jobs Report Insights

Sign up to watch our Jobs Report Video for even greater insights on this topic and receive supplemental reports and market data every month.